Australian retirees face many difficult financial decisions in retirement. Examples include the manner in which they invest their assets (both within and outside of super), the level of discretionary spending they enjoy, the timing and amount of assets that should be allocated to an annuity or other post-retirement product, and whether they should release equity from their home.

The Australian age pension, tax laws affecting non–super financial assets and the current economic environment in which retirees receive low returns from defensive asset classes complicate matters even further.

Our Methodology

As an example: increasing consumption depletes wealth, which in turn reduces the retiree’s investable time horizon and hence impacts the appropriate investment strategy for the retiree.

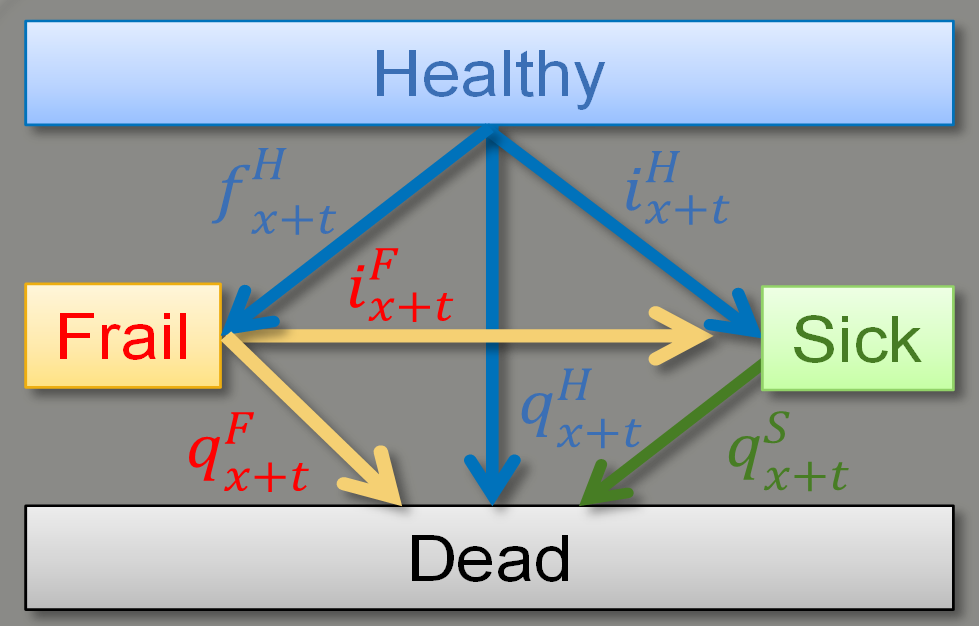

We start by considering a couple’s demographic experience. This is done by stochastically simulating differing health states for the retiree (healthy, frail or disabled) and adjusting the retiree’s minimum consumption needs and desired discretionary spending according to each health state. These demographic simulations are then considered in combination with stochastic simulations from different asset classes.

In each simulation year allowance is made for the impact of taxation, the Australian age pension and the potential for a retiree to dynamically adjust their strategy as their personal funding level and health status varies over time. In addition, at the end of each simulation year consideration is given to the potential that a retiree could purchase a post-retirement product such as an annuity, or release equity from their personal home.

Differing consumption, investment and product utilisation strategies are then explored and rated relative to the retiree’s preferences or goals. Each strategy is scored based on the manner in which the strategy:

reduces the risk of the retiree becoming wholly reliant on the age pension,

maximises the (utility adjusted) proportion of discretionary spending enjoyed

limits the risk of short-term capital loss from investment returns, and

reduces consumption volatility in retirement.

Understand the trade-off between enjoying consumption and increasing the risk of shortfall

The developed framework enables retirees to understand the implications of adopting a specific strategy.

We have developed an optimisation algorithm that can be used to help retirees find an appropriate strategy given their preferences, wealth, needs and health status.

To undertake the analysis many billions of calculations need to be performed. With modern technology and appropriate super-computing and optimisation techniques this analysis can now be performed in almost real-time.