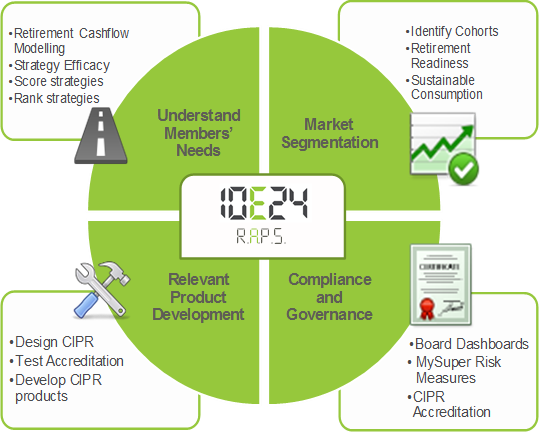

Solutions for Superannuation Funds

Introduction to RAPS – The Retirement Analysis and Planning Software Suite for Superannuation Funds

RAPS contains a suite of calculators that enable you to:

- Better understand your members’ needs,

- Compare and contrast the impact of adopting different investment, consumption, and post-retirement product purchase strategies for your members,

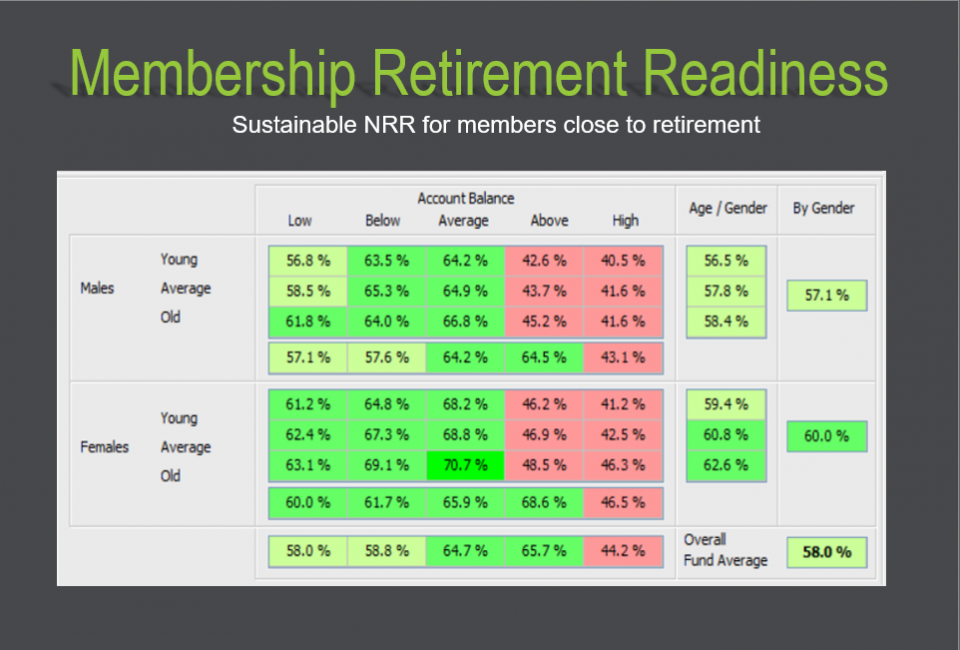

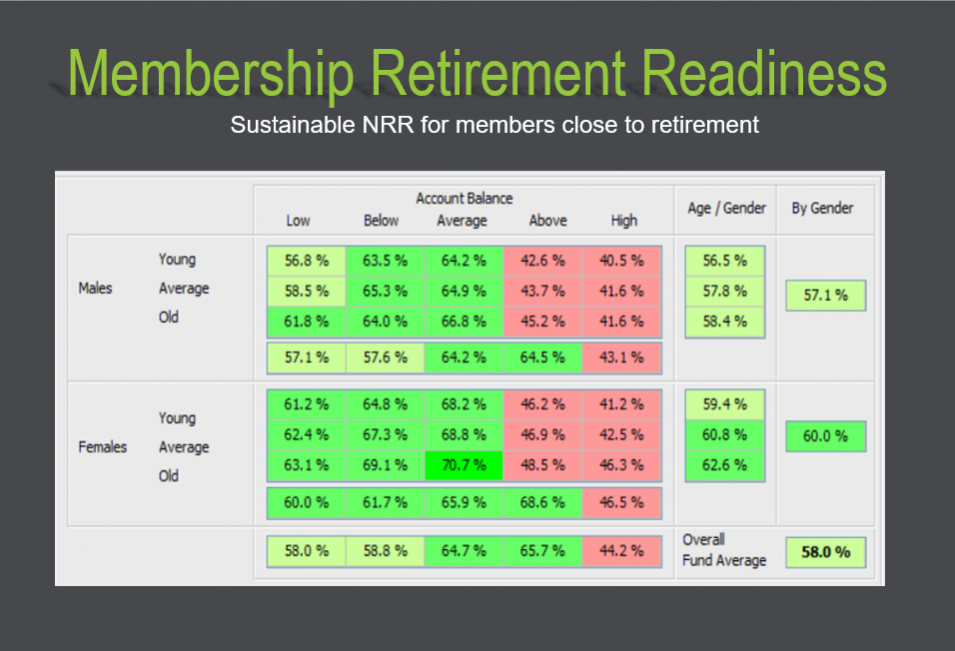

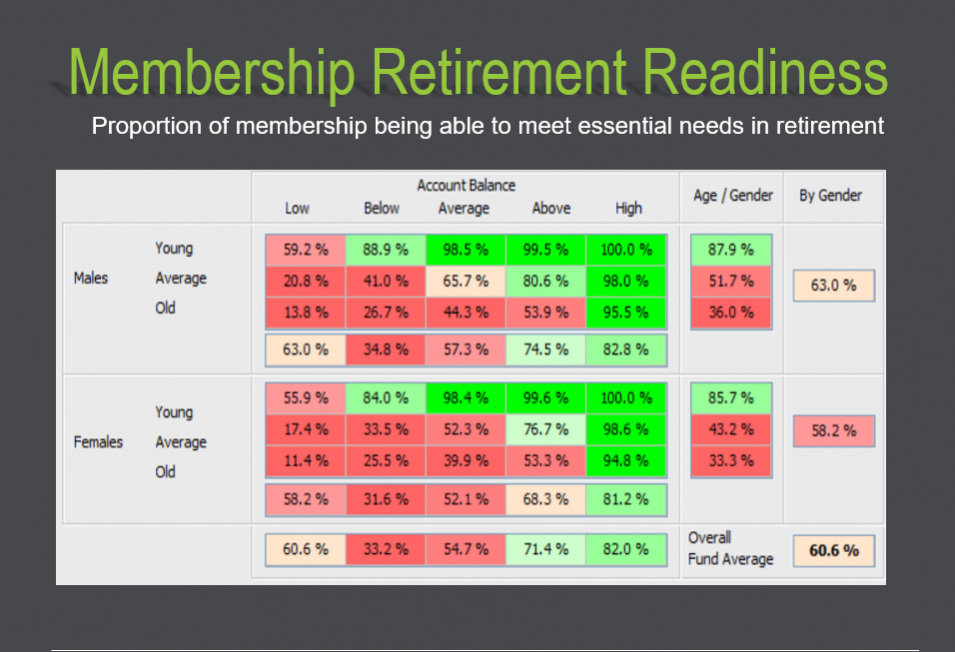

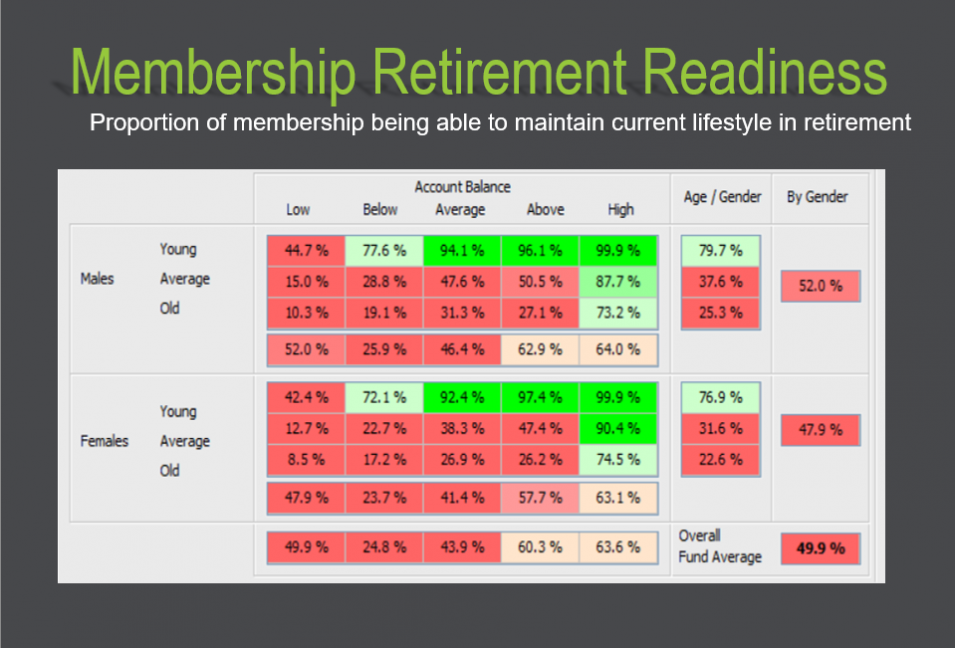

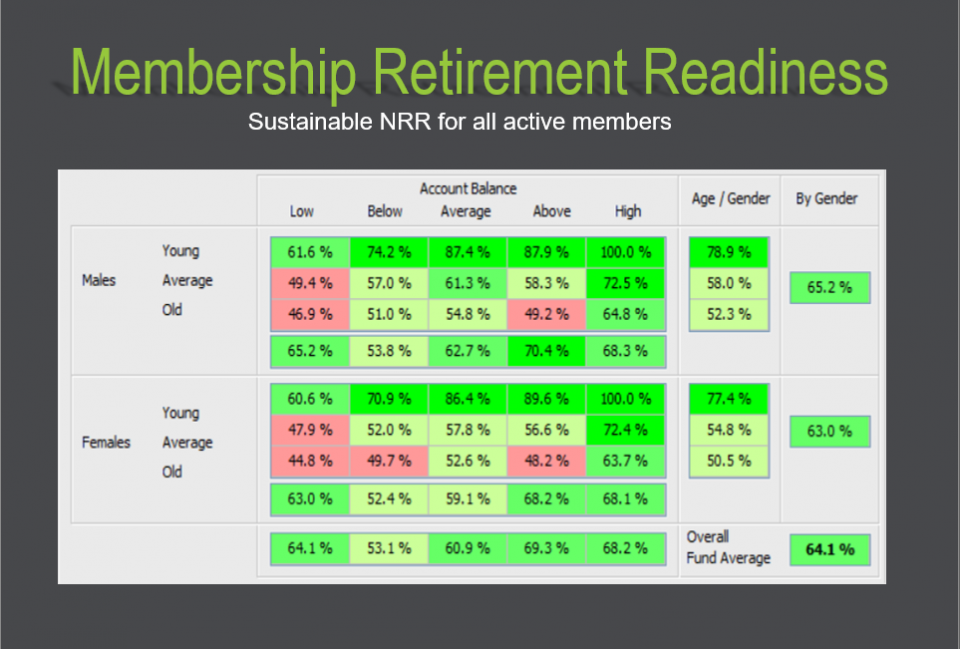

- Segment members by their retirement readiness,

- Design and build accredited CIPR products, and

- Monitor the Fund’s ability to meet members sustainable income needs in retirement

Key features:

- Calculation engine is stored in the cloud. Any changes to social security, taxation, Superannuation etc. are automatically updated on the server.

- RAPS runs on any modern browser. You can access your calculations from any device, anywhere, anytime.

- Written by actuaries and investment experts. We handle all the mathematical complexity to ensure that your internal teams can focus on design and strategy … rather than number crunching and statistical analysis.

- Lightning fast. RAPS can perform millions of retirement cashflow calculations in less than a second.

- Can be used by your internal product or marketing teams – so there’s no need to be overly reliant on your consultant.

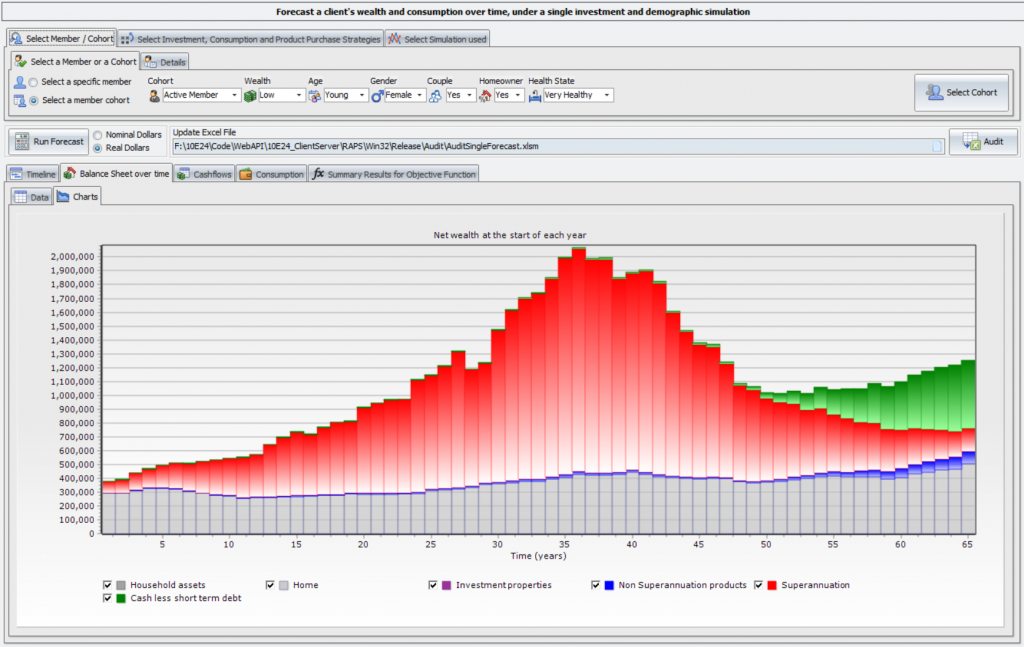

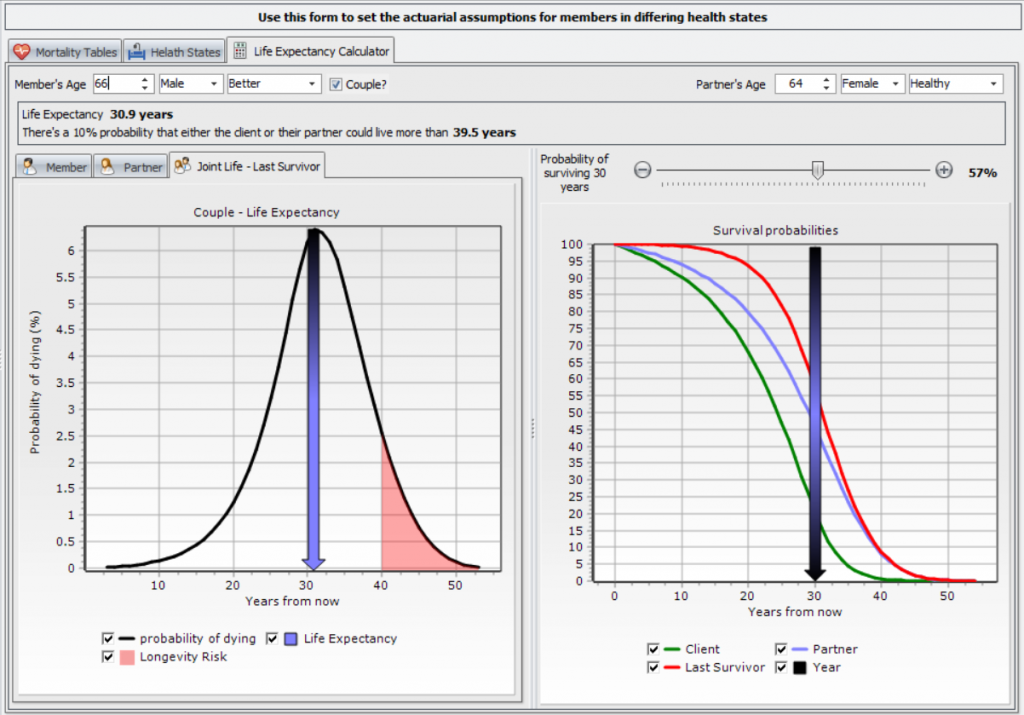

Whole of Life Cashflow Modelling

Retirement Cashflow Modelling

- Select any of the 2,000 investment simulations and 1,000 demographic simulations

- There are 2 Million possible scenarios that can be explored

- Or, you can run a deterministic calculation using expected returns, inflation and life expectancy

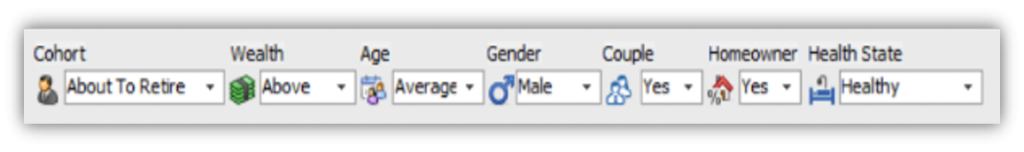

- Select a pre-saved member or cohort

- Select one of the saved investment, consumption, and product purchase strategies

- Forecast the household balance sheet and whether the member experiences financial difficulties.

Stochastic Retirement Planning Stress Tests

RAPS can handle real-world complexities:

- A couple retiring at different ages

- With differing savings rates

- And varying work patterns

- Age Pension

- Taxation (both in and outside Super)

- Home equity release strategies

- Assets outside of Super

- $1.6M Superannuation Cap and $25,000 SG cap

- Investment strategies for assets outside of super

- Rebalancing rules

- CIPRs within Super

- Mortgage debt, margin loans, geared investment properties

- Consumption strategies that are time varying, wealth varying and/or adaptive

- Age varying investment strategies

- Post retirement product purchase strategies

- and the list goes on…

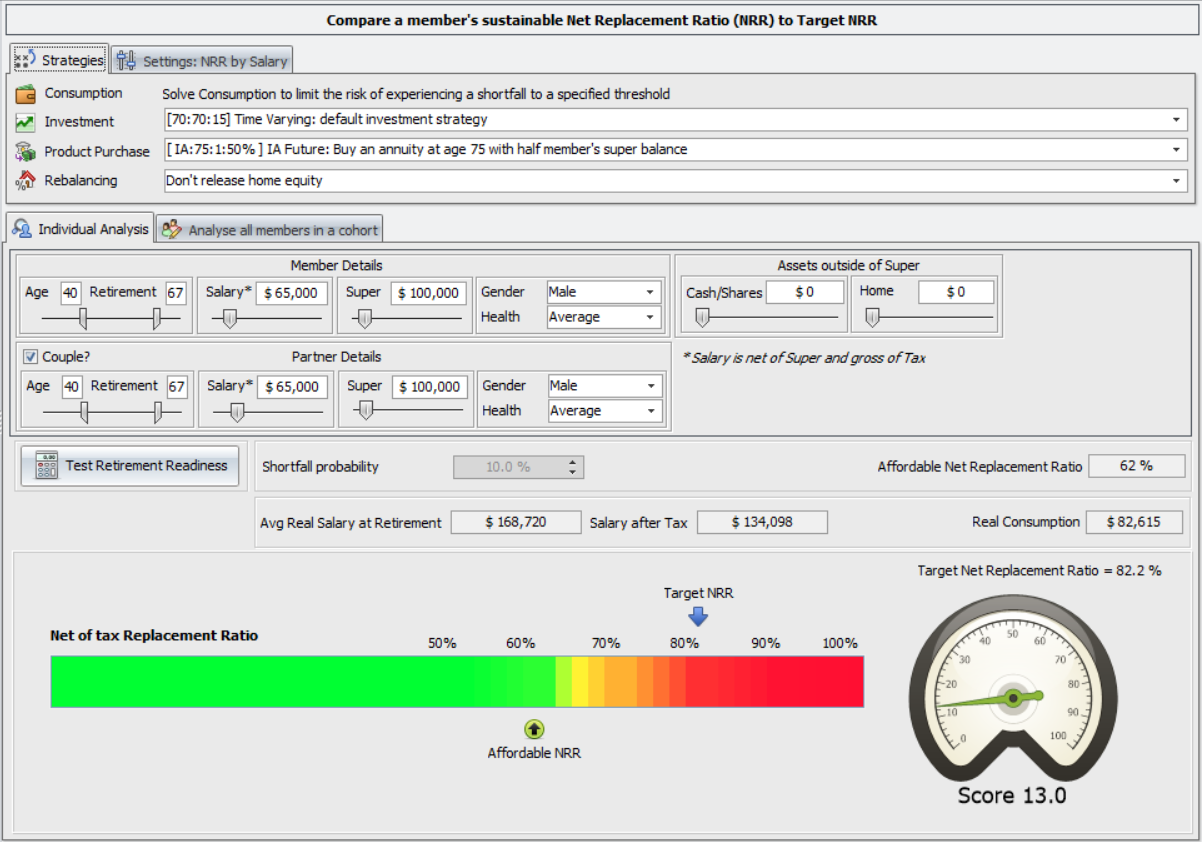

Sustainable Consumption in Retirement

RAPS includes our extremely powerful Sustainable Consumption Calculator

This calculator solves the amount differing member cohorts can sustainably spend in retirement, while limiting their risk of shortfall to a given threshold.

The calculator allows for:

- the age pension

- a couple – with a reduction in spending on first death

- home equity release

- differing investment strategies

- differing product purchase strategies.

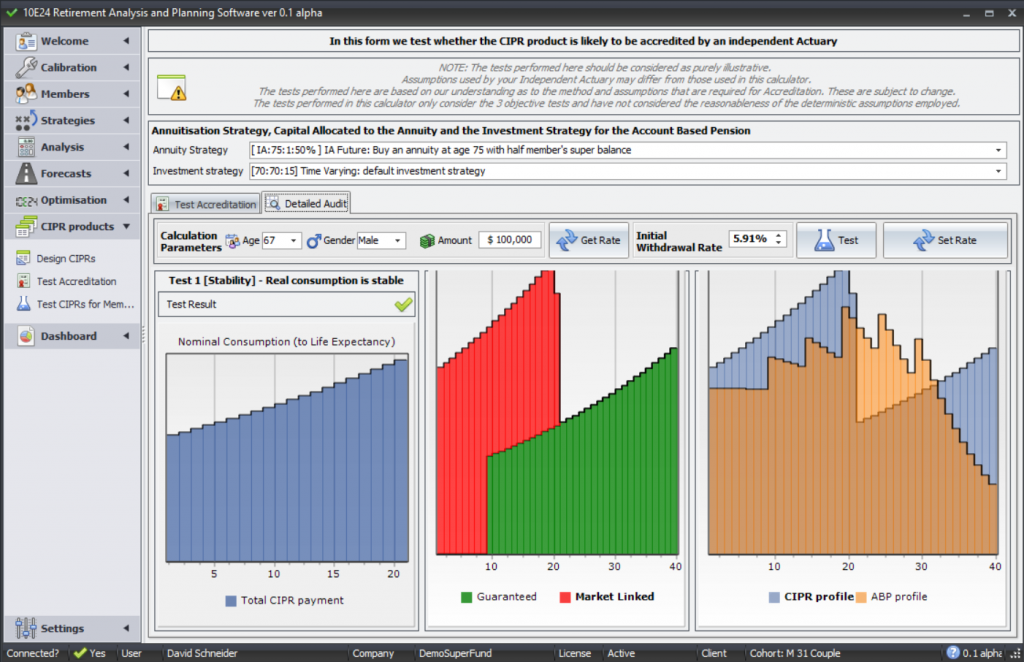

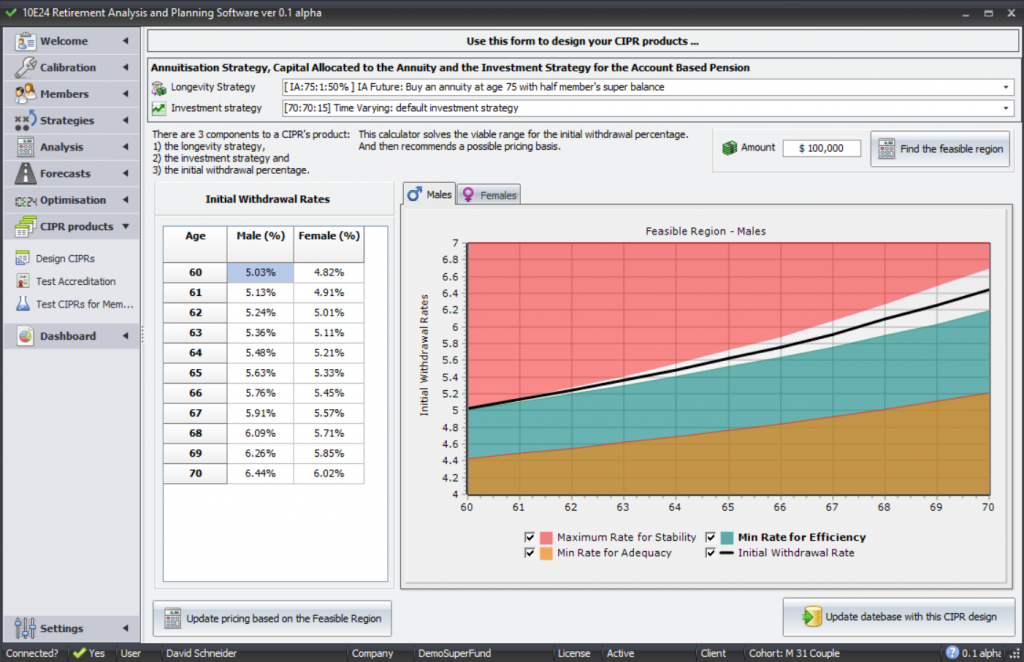

RAPS helps you develop an accredited CIPR

Automatically test whether your CIPR product is likely to be accredited.

RAPS automatically calculates the ‘feasible region’ of viable pricing rates. Saving you time and effort.

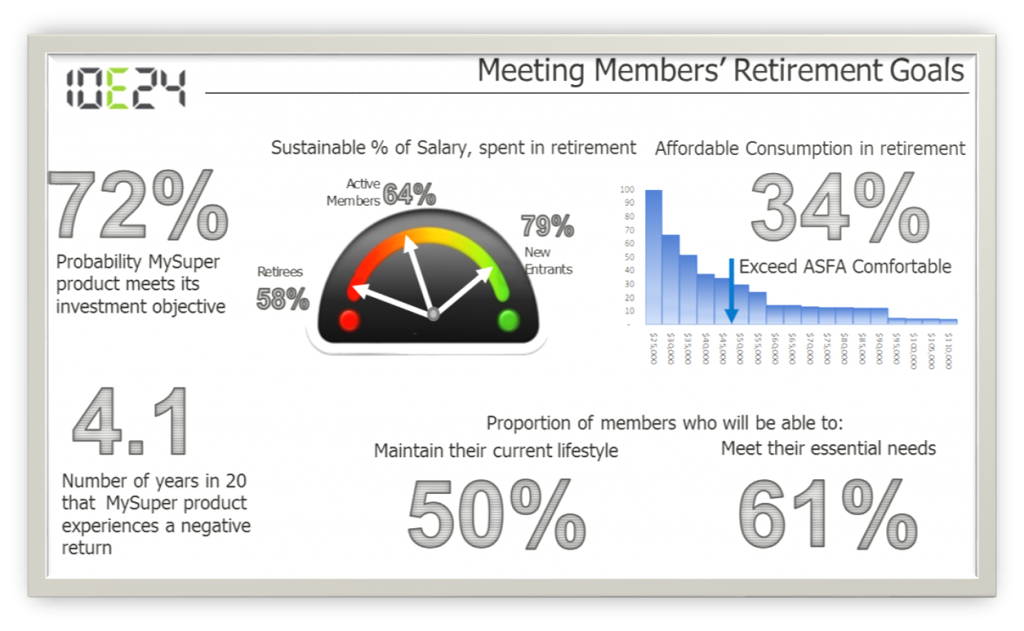

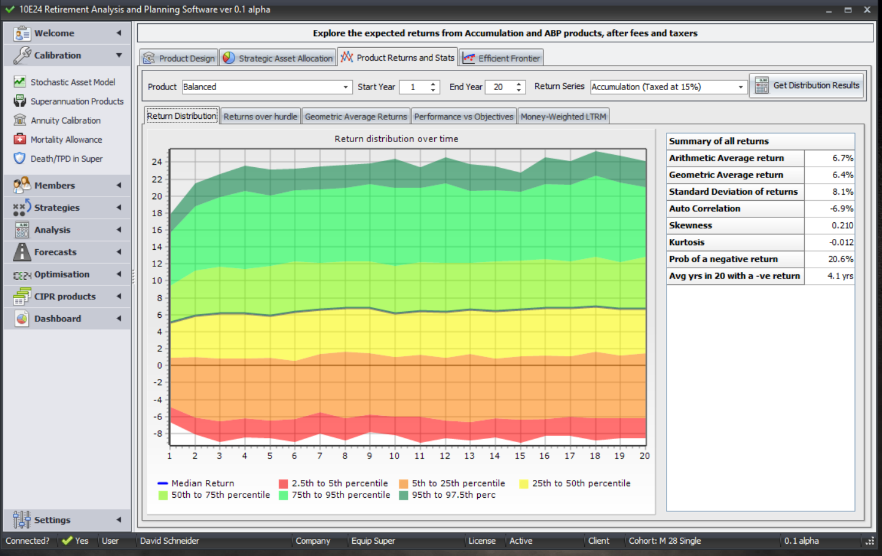

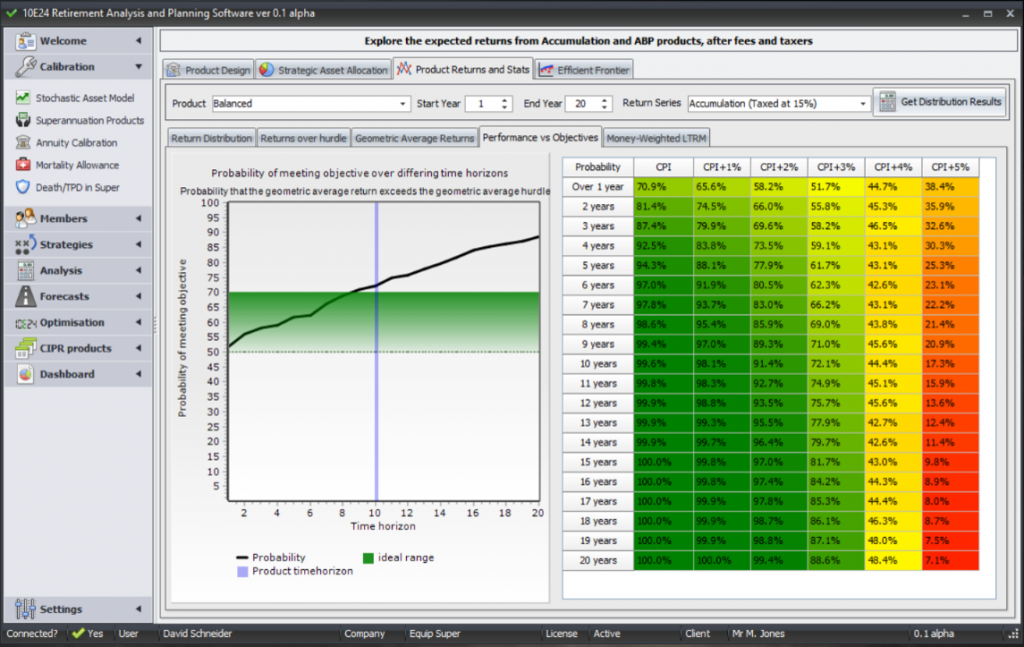

Compliance and Governance

Calculate the expected number of years that your MySuper product generates a negative return…

…along with a range of other essential statistics.

Calculate the probability that your MySuper product is expected to exceed its objective over differing time horizons.

Retirement Readiness Calculators

Dashboards for Board Governance and Monitoring