The 10E24 Asset Model

Key Features of our asset model

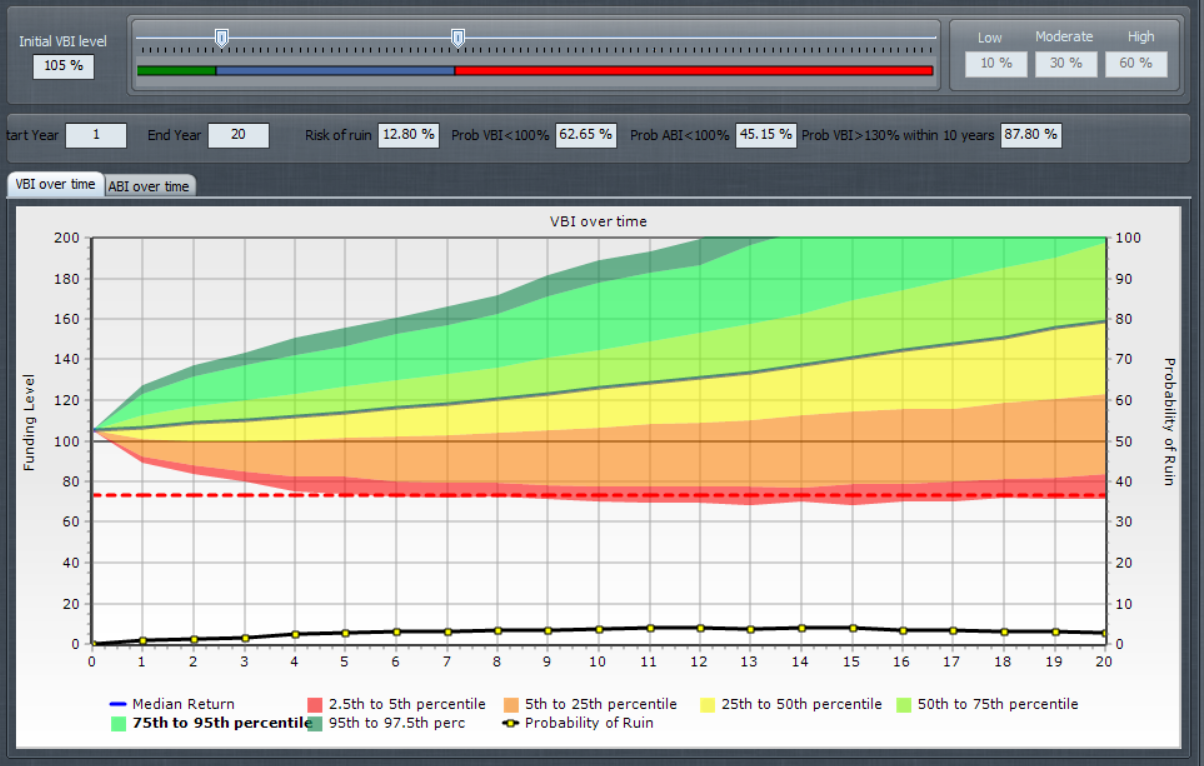

The 10E24 Asset Model stochastically forecasts inflation rate, bond yields and asset class returns. Our asset model enables users to measure and manage investment market risk, by projecting a large number of forward-looking scenarios, based on a wide range of economic and financial risk-factors. These scenarios allows asset owners to stress test the impact of investment markets.

Designed for defined benefit pension funds, general insurance companies, and life insurers – our modelling platform gives users a common integrated framework for developing economic scenarios. The 10E24 asset model is included in our RAPS suite of software.

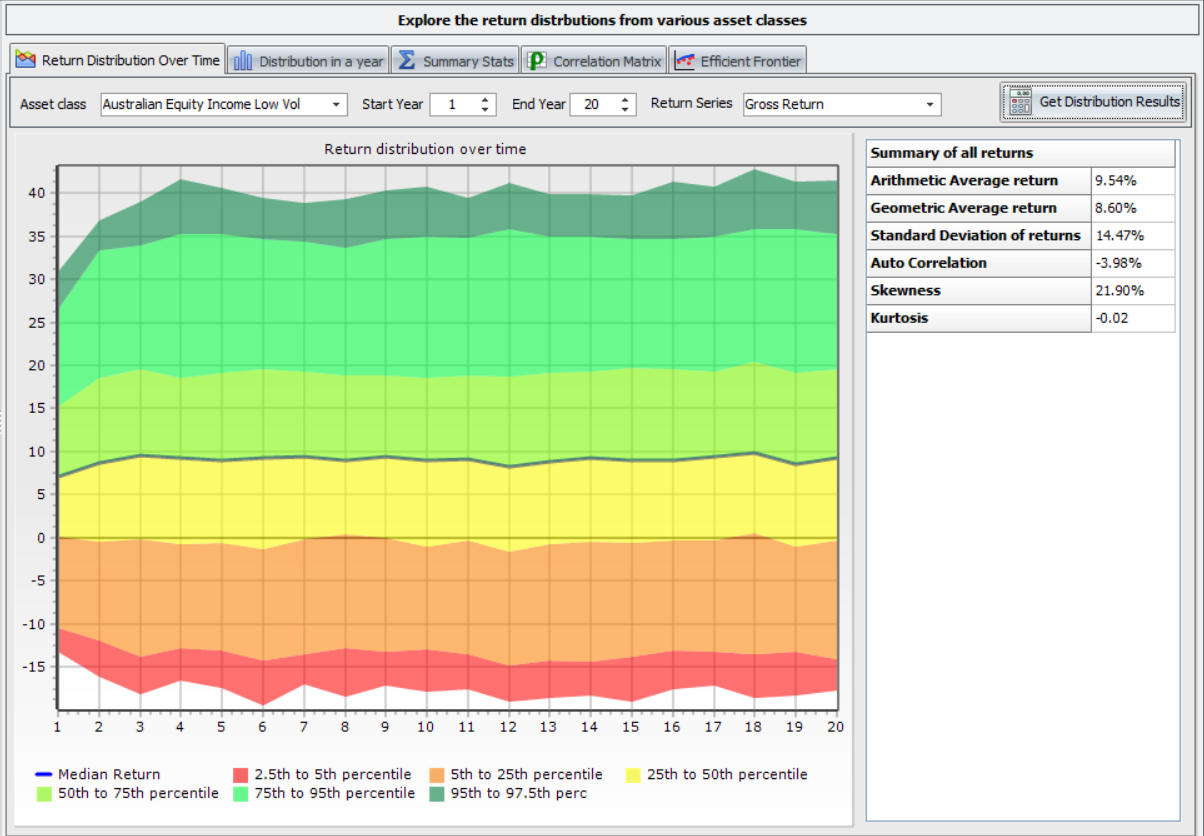

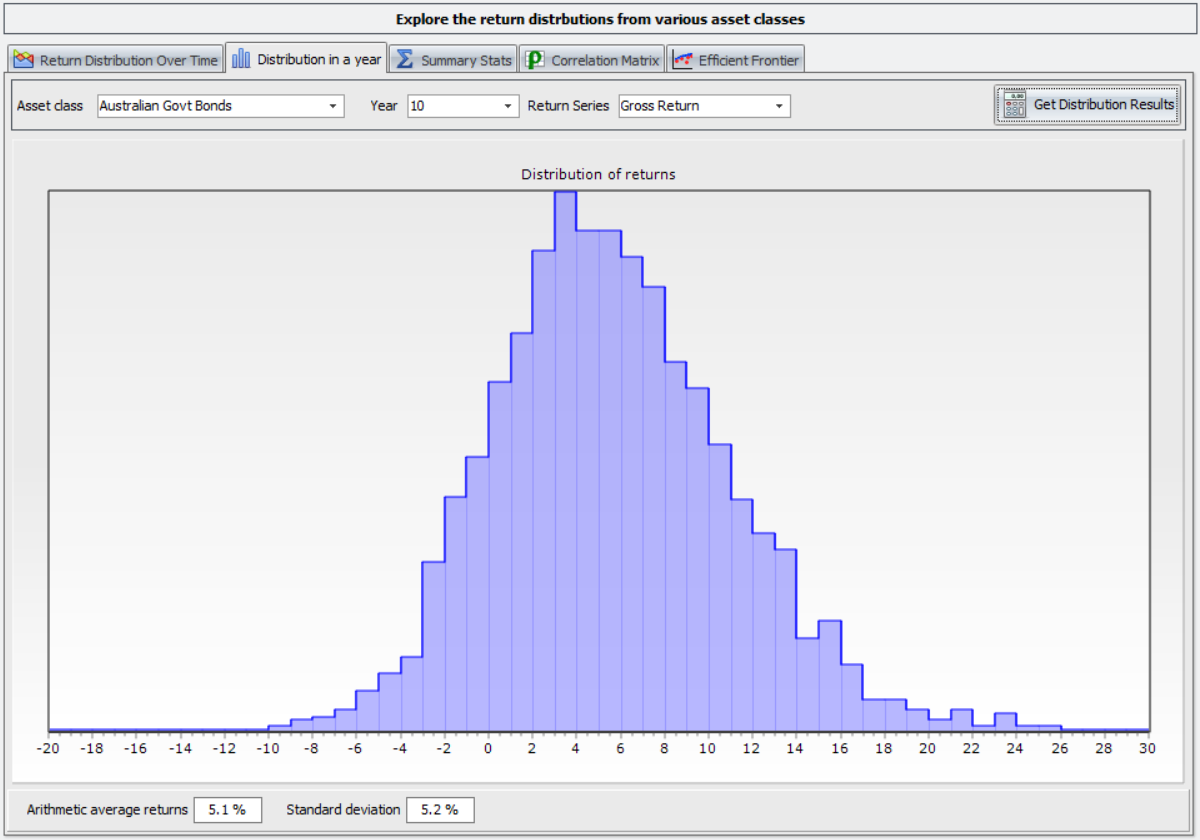

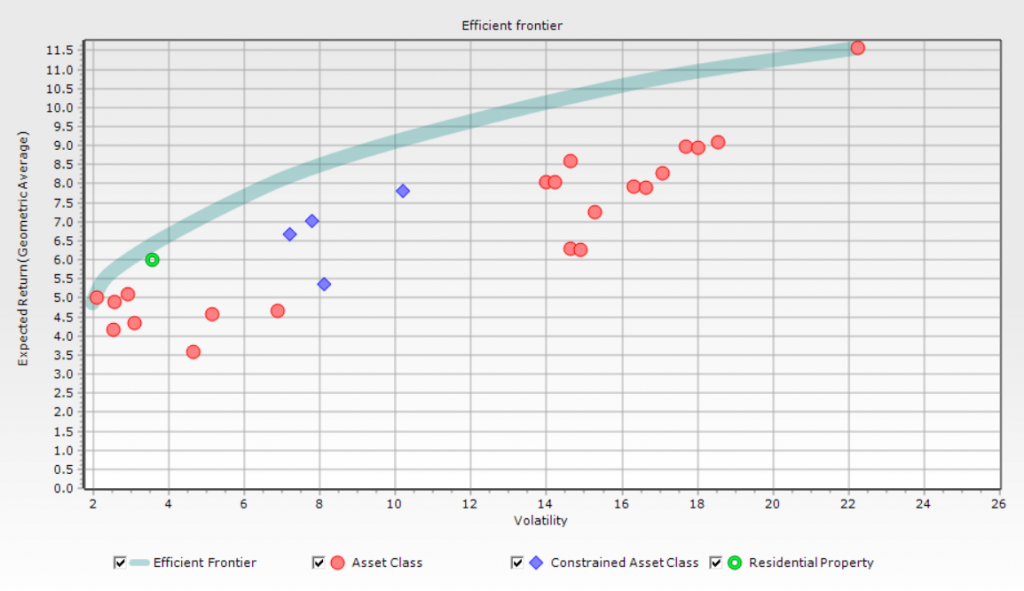

The asset model describes plausible paths of economic variables that are related in an economically coherent way, allowing for complex interactions between assets. Great care has been taken to ensure that asset classes generate economically consistent returns with a standard deviation, skew, kurtosis and appropriate correlation (both over time and across asset classes) that’s been calibrated against empirical historical data.

Constrained Efficient Frontier

Inflation Rates that are modelled

- Consumer Price Inflation

- Wages Inflation

- Medical Inflation

Interest Rates and economic risk factors

- Nominal bond yields across a range of durations

- Inflation Linked bond yields across a range of durations

- Rental yields, credit spreads

- illiquidity, momentum, credit, and volatility risk premia

Listed Asset Classes

- Domestic shares (mainstream, REITs, small cap, low vol, and high dividend yielding)

- International shares (mainstream, REITs, small cap, low vol, and high dividend yielding) on both a hedged and unhedged basis

- Emerging Market unhedged equities

- Government bonds (real and nominal, across a range of durations, both domestic and hedged international)

- Institutional grade Credit

Unlisted Asset Classes

- Residential property

- Hedge Funds

- Private Equity

- Infrastructure